Cash appears tighter than ever lately, and chances are you’ll be racking your mind for methods to avoid wasting. Budgeting, conserving automotive journeys, and deleting your procuring apps are an awesome begin, particularly as you trim spending on luxuries. However one easy financial savings transfer might have you ever counting much more money every month — switching banks.

Table of Content

- Switching Banks

- buy android installs

- ios keyword installs

- buy app store ratings

Incessantly, folks select a financial institution and keep it up for a number of years, even amidst seemingly minor inconveniences. Nevertheless, in the event you scrutinize your statements, you could be shocked to find years of pointless charges you’ve paid.

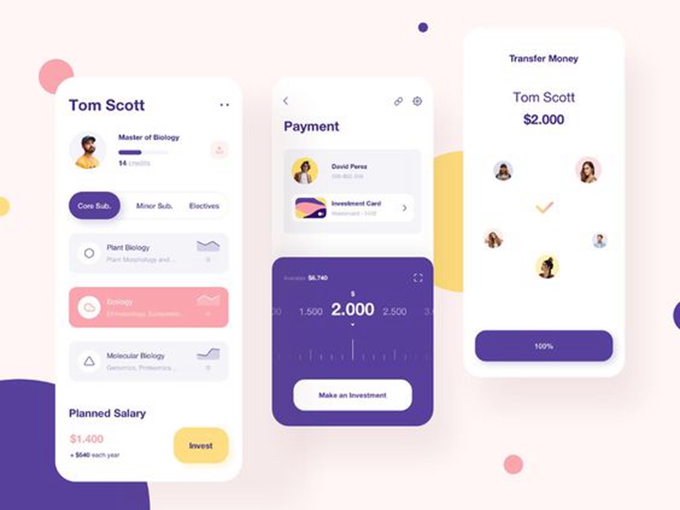

Antiquated establishments have loved slipping in charges, commanding minimal balances, and requiring extreme account relationships of their clients. However the fashionable option to financial institution is right here, and switching banks is extra handy and tech-savvy. Most significantly, it may well prevent cash each month.

1. Get rid of Ridiculous Charges

If you begin to consider it, isn’t it loopy that banks cost you cash simply to have an account?

Many banks cost clients month-to-month charges for issues like account upkeep, which often make no enhancements in service. Worse but, others cost charges for dipping beneath a minimal steadiness in your checking account.

As you take into account switching banks, search for a financial institution with no charges, particularly for accounts prone to ebb and stream along with your each day wants. Your debit card transactions connect with your checking account, which can trigger your steadiness to go up and down. If an establishment is charging minimal steadiness charges, it’s a pink flag to look elsewhere.

Whilst you store for a brand new financial institution, pull up your present account phrases to evaluate options and advantages. Make observe of the charges you at the moment pay and will pay in the event you make a mistake or want help. You might not have been charged these charges but, however the specter of them is sufficient to encourage a swap.

2. Go Digital to Save Time and Trim Your Fuel Finances

Brick-and-mortar banks supply some advantages, however with simply accessible and dependable web and digital cost choices, they’re not crucial.

Go digital along with your banking and take into account a fintech or on-line financial institution. You’ll skip the necessity for journeys to a financial institution department, saving you valuable time and gas.

Make deposits by means of your financial institution’s app the following time you get a examine. After you’ve uploaded your examine picture into your app, write VOID on it, and preserve it someplace protected till it clears. And in the event you’ve acquired money to stash, you are able to do so at a taking part ATM.

Normally, digital banks associate with ATM networks which can be related to common pharmacies or gasoline stations. This vast attain means you’ve acquired financial institution entry in hundreds of areas nationwide, not simply in your neighborhood.

3. Make Financial savings Computerized When You Spend

If making a financial savings behavior has been a problem, take into account banking with an establishment that makes it straightforward. Spherical-up purchases are a typical means that some banks assist their clients save with out even attempting.

If you swipe your debit card, the transaction rounds up the change to the closest greenback. This further change is straight away deposited into your related financial savings account. Again when money was king, you may need stowed your change in a jar. A round-up saving function is a digital equal, permitting you to reap the advantage of painless financial savings deposits.

To spice up your financial savings additional, arrange secondary automated transfers if you obtain your paycheck. Deal with your monetary objectives like a invoice. Provoke a switch each payday or everytime you earn a bonus.

Usually, you may open a number of financial savings accounts with one buyer profile. Use this follow to avoid wasting for short-term objectives like a trip or long-term objectives like a brand new automotive.

4. Financial institution With an Establishment That Has Your Again

Typically you simply get the maths incorrect. Or your deposit doesn’t hit if you thought it was imagined to. All of the sudden, your account is overdrawn, and also you’re in a panic.

With newer banking choices, you will get overdraft safety with out the budget-busting payment.

Join your financial savings account to your checking to cowl your misstep, and your establishment will make the transaction for you. When you’re conscious of your flub beforehand, you should use your banking app to make the switch your self.

Different instances, your weekend away contains the casualty of a misplaced debit card. Some establishments cost you a payment to exchange it, even blacklisting you if this occurs too regularly.

Kinder, extra customer-focused banks perceive that life occurs. Search for a financial institution that may ship you a substitute, everytime you want it, no questions requested.

Whilst you anticipate its arrival, disable your card your self utilizing your app — no want for a panicked name. You’ll keep away from the catastrophe of fraudulent prices and the necessity to restore your stolen steadiness.

Make Closing Your Previous Account as Painless as Potential

The siren music of saving cash and having a extra nice banking expertise could have you ever giddy about making the swap. However don’t let your pleasure trigger you to fumble this main monetary transition.

First, open your new account and arrange your contact data, two-factor authentication authorization, and restoration contact. Subsequent, replace your direct deposit data for anyplace you obtain cash, like your employer, cost purposes, and exterior accounts. Permit for 2 profitable direct deposit cycles earlier than you make strikes to shut your outdated account.

Affirm that your financial institution has set your new account up for deposits. After that, you may replace any outgoing funds to your new financial institution.

Be affected person as you transition your incoming and outgoing transactions over the following few weeks. Keep in mind, the objective is to save cash, not rack up pointless late charges and penalties.

Then, and solely then, attain out to your present establishment and allow them to know you’re prepared to shut your account. Now you’re prepared to save cash for years to return, all because of your new, fashionable financial institution.