Up to now few years, a lot of applied sciences and tendencies have entered the Insurance coverage area. They’ve given a brand new outlook to the trade, whereas providing options to manage up with a number of challenges prevailing available in the market.

Table of Contents

- App Development Costs

- buy aso services

- buy app installs

- play store ranking service

One such development that has modified the panorama of the area is On-demand insurance coverage.

The On-demand mannequin in insurance coverage trade has introduced into higher alternatives for customers and have made it simpler for them to say an insurance coverage coverage as per their wants. This has not solely attracted customers, however have additionally inspired entrepreneurs to look solutions for questions round how a lot does On-demand insurance coverage app improvement price. One thing we’ll cowl on this article.

However earlier than we disclose the fee worth, it’s good to know who you might be competing towards and put together your self accordingly.

So, let’s dive into the market and see what are the highest on-demand insurance coverage apps.

Prime Gamers within the On-demand Insurance coverage Market

All these purposes, come what may, have given a raise to the normal on-demand insurance coverage area. One thing about which you’ll study higher by going by way of the following part wanting into the problems these apps have solved.

Points That On-demand Insurance coverage Apps like Trōv Have Solved

1. Insurance coverage for A number of Issues

Earlier, there have been restricted forms of cell insurance coverage apps. Customers had been capable of declare an insurance coverage just for automobiles, mobiles, touring, and healthcare options.

However, with the appearance of on-demand insurance coverage purposes like Trōv and Verifly (now Thimble), insurance coverage for varied different professions and units has come true. This has opened an entire new world of alternatives for companies to enter the area.

2. Quick-term Insurance coverage

With the altering working mannequin, the necessity for long-term insurance coverage protection was changing into a less-required factor. Customers had been anticipating versatile insurance coverage fashions, similar to their jobs.

That is one other hole that Trōv-like insurance coverage apps stuffed by offering brief and on-demand insurance coverage to their person base.

With this now attended to, it’s seemingly that you’d wish to know the On-demand insurance coverage app improvement price and make your entry official within the area.

However, earlier than you get to the state of realizing the estimate of the price of Verifly clone app or that of Trōv, it’s crucial to be accustomed to the options and functionalities which can be widespread in each.

Options to Introduce in Your On-demand Insurance coverage App Improvement Course of

1. Decide a Class

Since purposes like Trōv and Verifly covers insurance coverage of over 100 totally different objects, and never simply on vehicles like what State Farm does, choosing a class is the foremost function to have a look at.

This function provides customers a chance to decide on the kind of insurance coverage they need out of tons of of obtainable choices .

2. Cost Reminders

Cost reminders facilitates customers with on-time reminders about fulfilling the requisites, and different payment-related providers.

3. Custom-made Insurance coverage Coverage

Right here, customers get an choice to customise the obtainable insurance coverage coverage choices based mostly upon the timeframe and different primary wants.

4. In-App Chat

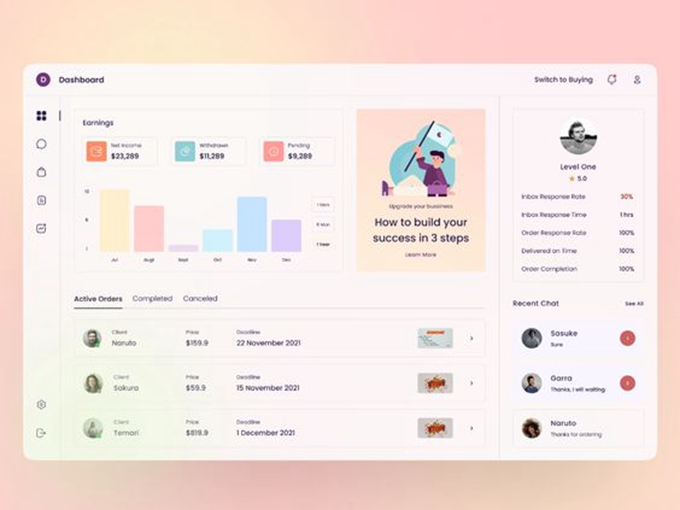

In-app chat is one more function that ought to be launched within the course of to develop on-demand insurance coverage app like Trōv, verifly, certain, and cuvva.

This function allows customers to have a real-time communication with brokers by way of in-built chatbots and get readability of what sort of insurance coverage plan they need to put money into, alongside discovering options to different challenges they’re going through.

5. QR Code Scanner

This function can be vital within the software from the attitude of verifying the authenticity of any coverage.

6. Foreign money Conversion

One other function that’s typically seen in Trōv-like cell apps is Foreign money Conversion. That offers customers the chance to transform currencies from one kind to a different in real-time.

Whereas these are the options that ought to be taken into consideration whereas designing an on-demand insurance coverage software, it’s also good to have an understanding of their UI/UX design to make sure that you construct a worthwhile app out of the funding you probably did when it comes to price to develop Trōv clone app.

UX/UI Takeaways of On-Demand Insurance coverage Apps

1. Easy and Straightforward Signal-up Course of

On-demand insurance coverage apps like Cuvva, Trōv, and Verifly ask for restricted data throughout sign-up course of and encourage customers to fill out all the non-public particulars later.

This expertise, which is without doubt one of the key drivers behind their recognition, is in sync with their purpose to supply insurance coverage within the case of emergencies.

2. Trouble-free Search Performance

Relatively than simply including a search button on the highest of the display screen, they’ve additionally talked about the highest searched phrases. This makes it simpler for customers to proceed additional in case they wished to go looking the identical key phrase/phrase.

3. Card Design Structure

Card format, which was one of many prime cell app UI tendencies final 12 months, additionally contribute to creating these purposes common.

This makes it simpler to distinguish between totally different parts current on the applying; giving them a clear and completed look. One thing that reduces the possibilities of customers getting confused and exiting the platform earlier than a speculated time.

Additionally, these apps have embraced the concept of minimal design which has made it simpler for customers to give attention to the principle goal, slightly than getting distracted by the animation, and different such choices obtainable on the display screen.

So, these are the experiences which have made customers drawn to such apps. Nonetheless, they haven’t made this potential single handedly. These options are backed by an entire set of programming languages, frameworks, and instruments that makes them succesful to carry out effectively and rule customers’ thoughts.

Selecting the finest expertise stack to your cell app performs an enormous position in its success fee. This, in flip, signifies that having a information of what tech stack do purposes like Trōv and Verifly use, may be very useful.

So, let’s look into their tech stack, earlier than leaping onto the on-demand insurance coverage app improvement price part.

Tech Stack for On-demand Insurance coverage App Improvement

Whereas all the knowledge that you simply now have on On-demand insurance coverage cell app tech stack and options, would possibly make it seem to be the app improvement course of is simpler, it’s not so.

The method to construct Trōv & verifly like insurance coverage cell app is accompanied by varied challenges that app improvement firms and on-demand insurance coverage enterprise lovers must take care of.

So, that can assist you be accustomed to such challenges and construct higher methods for a profitable entry into the on-demand app market, let’s uncover among the widespread enterprise and improvement challenges right here.

Enterprise and Improvement Challenges You May Face Whereas Constructing Trōv-like App

1. Insurance coverage Frauds

The foremost problem that each On-demand app builder and enterprise folks has to unravel is to ship a safe expertise.

The structure of on on-demand insurance coverage platform is advanced one when it comes to the preparation that must be achieved for fraud monitoring and fraud administration. It’s tough to differentiate between a real and fraud incident, which makes it extra susceptible to hacking, phishing, and identification theft.

In addition to, the declare dealing with course of will not be translucent. This makes it tough to ship a personalised and safe expertise to customers.

2. Knowledge Breach Risk

Knowledge breaches can be one of many largest challenges in growing on-demand insurance coverage cell apps.

It’s because such purposes collect, retailer, and course of a heap of buyer private information, due to which it turns into a playground of a number of hackers and cyberintruders on the lookout for loopholes within the structure.

3. Decrease Income Era

In contrast to conventional insurance coverage apps the place customers pay premium quantity for long-term, these purposes supply short-term and on-demand insurance coverage. Right here, the chance of prevalence of an accident or calamity is increased, which signifies much less likelihood of constructing income.

With all of the technicalities mentioned, let’s transfer to the On-demand insurance coverage app price estimate part.

How A lot Does On-demand Insurance coverage App Improvement Prices?

The reply to how a lot does it price to construct an insurance coverage app like Trōv and Verifly will not be sure. It’s because cell app improvement price differs on the premise of a number of components like app complexity, variety of platforms you goal, the units you make your app obtainable on, the placement you goal, the app improvement workforce you rent, the kind of design and improvement instruments you choose, and so on.

So, probably the most optimum technique to comply with to know the precise Trōv like app improvement price breakdown is to seek the advice of with the finest on demand app builders.

Now, whereas this would possibly allow you to with getting an understanding of how a lot you could put money into On-demand insurance coverage app improvement course of, let’s uncover tips on how to earn the cash again.

Enterprise and Income Mannequin of On-demand Insurance coverage Apps

Trōv like insurance coverage apps function with totally different usage-based insurance coverage fashions to make income. Nonetheless, the three widespread monetization methods they comply with are:-

1. Promoting Mannequin

A lot of the On-demand insurance coverage apps generate profits by permitting different firms to publish their commercial on their platform.

2. Subscription Mannequin

An On-demand brief time period insurance coverage app additionally considers subscription mannequin for incomes cash.

This is without doubt one of the finest monetization methods the place a person has to pay a subscription payment to get pleasure from premium options of insurance coverage app for a time frame. As soon as the time interval expires, they’re requested to pay the quantity once more.

3. Referral Advertising and marketing

Referral advertising and marketing, the important thing participant behind e-commerce success, can be thought-about by these on-demand insurance coverage platforms for incomes increased downloads and income.

The method encourages customers to share the applying with others in return for some reward. And this fashion, make it simpler for insurance coverage purposes to return throughout a brand new person who would apply for an insurance coverage with out placing a lot efforts.

Now, whereas this On demand insurance coverage app income mannequin is apt for the current time, it won’t be sufficient for the longer term. And the prime cause behind is that the audience on this market are millennials. They demand extra standard insurance coverage options and higher integration of applied sciences within the course of, which makes it essential to maintain updating your app providing.

So, whereas focusing on this course, it’s good to look into suggestions and tendencies that can make your software ‘millennials-ready’ each for current and future time. One thing with which we’ll wrap up this text with.

Suggestions and Developments to Watch Out for Making On-demand Insurance coverage App Profitable

1. Introduction of Blockchain and AI

Whereas AI is already being in use within the type of chatbots, there’s extra to what this expertise can supply to the insurance coverage area. It could collect, analyze, and supply higher personalised and secured choices utilizing the ability of predictive analytics.And, when speaking about Blockchain, it introduces must-required transparency and safety to the delicate shopper information that these apps take care of.

2. App Localization

Most of on-demand insurance coverage purposes are confined to a specific area or nation. Due to this, solely the native residents of these areas are capable of reap the benefits of their providers.

However, by localizing your app, you may make the advantages of on-demand insurance coverage app obtainable to a wider vary. This is not going to solely improve your app downloads, however will even make it simpler so that you can goal a wider viewers and improve your model fame available in the market.