On this CIO Insider, we discover overarching developments in expertise spending based mostly on knowledge from Deloitte’s 2020 International Know-how Management Examine. We additionally look at the short- and long-term impacts of COVID-19 on expertise budgets and investments, and examine the spending habits of expertise vanguards, corporations which might be extra superior than their friends. Lastly, we rethink conventional expertise spending practices and capital allocation.

The 2020 International Know-how Management Examine tracks the evolution of organizations, their expertise capabilities, and the function of expertise leaders. The survey knowledge reveals that between 2016 and 2020, greater than half of survey respondents reported year-over-year finances will increase, whereas for others, budgets remained regular. Nevertheless, we collected our 2020 knowledge earlier than COVID-19 sparked an unprecedented humanitarian and financial disaster that made a right away and far-reaching impression on short- and long-term enterprise methods.

Many CIOs undoubtedly needed to make deep finances cuts, particularly in sectors during which stay-at-home mandates restricted bodily interplay, together with journey and hospitality, meals providers, retail, sports activities, and leisure. Nevertheless, understanding COVID-19’s impression on expertise spending requires nuance—though organizations made substantial cuts in spending in nearly each class, we noticed flat or rising expertise budgets in most organizations. In actual fact, many expertise leaders reported that the pandemic introduced a chance to rapidly recalibrate expertise investments, and in lots of circumstances, hasten present funding plans. “Some of the attention-grabbing features of the COVID-19 disaster is that, for a lot of corporations, the pandemic was extra of an accelerator than an impediment,” says Sunil Potti, vp, and common supervisor for Google Cloud. “Whether or not they have been launching digital transformations, new workforce-access fashions, or up to date buyer interplay applied sciences, many proactive corporations used the disaster to make issues higher—to get to a ‘safer and higher regular.’”

Contemplate, for instance, a couple of ways in which expertise spending has modified:

- Distant work. To help the fast transition to a distributed workforce, many expertise leaders shored up their expertise infrastructures and deployed instruments that nearly and securely carry individuals collectively and assist them collaborate.

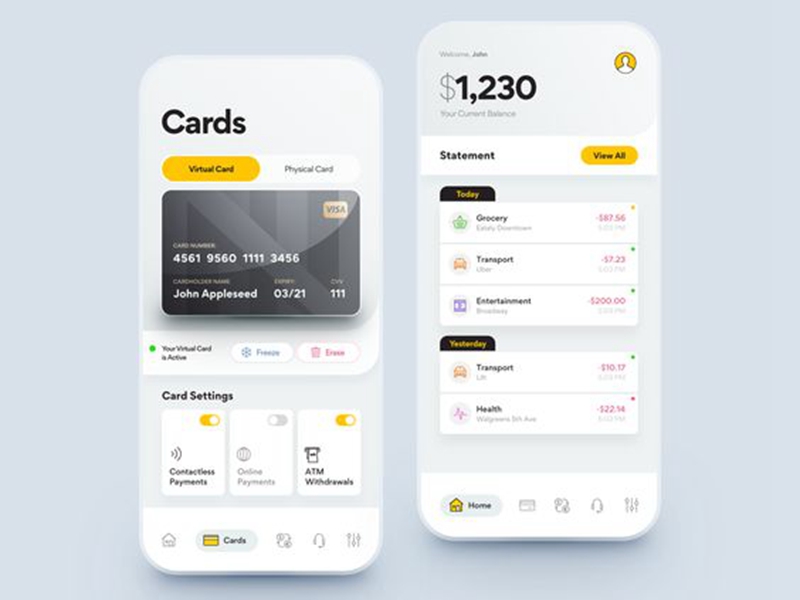

- Digital financial system. In response to adjustments in consumption patterns pushed by stay-at-home orders, many CIOs doubled down on the digital applied sciences that drive e-commerce, telehealth, on-line studying, contactless funds, and different on-line shopper developments.

- Provide chain enhancements. COVID-19 uncovered main provide chain weaknesses, together with demand surges and drops, lowered productiveness, uncooked materials shortages, and storage and product dealing with points. And so, COVID-19 turned a stunning catalyst for the adoption of resilient provide chain evaluation and administration options.

- Automation. Workforce shortages required organizations to search for alternatives to automate processes and scale back human involvement, with automation usually taking up duties that people didn’t wish to or couldn’t do. Although many organizations have been already working to extend effectivity and enhance time to market by important investments in automation, particularly robotic course of automation (RPA), the pandemic accelerated these investments.

Know-how finances as a proportion of income generally is a beneficial barometer for evaluating trade spending propensity. Previous to the pandemic, enterprises had deliberate to extend expertise spending on common to 4.25% of income. Nevertheless, the deliberate quantities diverse extensively throughout industries, from lower than 2% to greater than 10% (determine 1).

As well as, many CEOs and CFOs anticipated expertise leaders to spend money on applied sciences that create demonstrable enterprise worth by delivering development and innovation. On common, survey respondents reported investing 15% of their budgets on enterprise innovation initiatives, however they spent most finances {dollars} (59%) in day-to-day enterprise operations. We noticed some notable variations in how industries invested pre ̶ COVID-19 expertise {dollars}, with expertise and telecommunications; journey, media, and hospitality; and enterprise {and professional} providers main the pack in innovation investments (determine 2).

Spending habits of expertise vanguards

The 2020 International Know-how Management Examine recognized a subset of organizations that have been extra subtle than their friends within the areas of imaginative and prescient and technique, expertise perform maturity, and market management. We discovered that these superior organizations, which we name expertise vanguards, lengthen their progressive pondering to expertise budgeting and funding methods.

For instance, expertise vanguards spend a better proportion of income on expertise (4.8%) than baseline organizations (4.2%), and they’re greater than twice as doubtless (24% in comparison with 11%) to challenge substantial will increase of their expertise budgets over the earlier monetary yr. Extra spending doesn’t all the time imply extra worth, however these expertise vanguards are actually allocating their expertise budgets in another way. It was additionally attention-grabbing to notice that expertise vanguards have been pretty evenly distributed throughout industries and constituted roughly 10% of the general inhabitants.

Basically, whereas baseline organizations have been extra inclined to prioritize value and effectivity initiatives, expertise vanguards have been extra more likely to prioritize innovation, development, and prospects. Vanguards’ development orientation doubtless drives them to take a position sooner or later, which we anticipate to proceed because the financial system regains its footing. Due to the strategic significance of innovation and development to the general enterprise, expertise vanguards on common allocate higher parts of the expertise finances (20%) to innovation than do baseline organizations (15%). These main organizations intend to extend innovation spending considerably through the subsequent three years to 30%, in comparison with 23% for baseline organizations (determine 3).

Whereas baseline organizations have been extra inclined to prioritize value and effectivity initiatives, expertise vanguards have been extra more likely to prioritize innovation, development, and prospects.

A earlier research indicated that vanguards have been additionally much less doubtless than baseline organizations to spend closely in enterprise useful resource planning (ERP) platforms or different foundational applied sciences, probably pointing to vanguards’ capacity to steadiness the “innovate” and “function” components of expertise investments higher.

In interviews, we discovered that expertise vanguards are extra doubtless than their friends to give attention to organizational agility and enterprise partnership. Forty-two p.c of expertise vanguards say their organizations are shifting to a product working mannequin and are taking an agile strategy to each enterprise and expertise, in comparison with solely 14% of baseline organizations. This implies their approaches to expertise budgeting, investing, and measurement are versatile and iterative, enabling them to reallocate investments and pivot rapidly whereas delivering ongoing worth.

Conventional expertise funding, budgeting, and funding processes—equivalent to function-specific budgets, long-term funding cycles, and conventional procurement and vendor administration practices—conflict with the ideas of organizational agility, cross-functional groups, iterative sprints, and new methods of working. Quick-term, value-based investments and rolling funding fashions could make it simpler to shift expertise sources to allow clever “quick failures” in innovation and help quickly altering enterprise and financial environments.

Whether or not they lead a expertise vanguard or baseline group, CIOs will doubtless be confronted with quickly altering enterprise, financial, and geopolitical environments and will discover methods to rapidly pivot, reallocate funds, and reprioritize investments. As a result of we anticipate expertise investments to develop steadily because the pandemic ebbs, many expertise leaders could must rethink conventional expertise funding practices.

Whether or not they lead a expertise vanguard or baseline group, CIOs will doubtless be confronted with quickly altering enterprise, financial, and geopolitical environments and will discover methods to rapidly pivot, reallocate funds, and reprioritize investments.

Rethinking expertise funding practices

Conventional expertise funding practices can typically produce investments which might be siloed, rigid, and opaque. To maximise the worth of expertise investments, practices associated to finances planning, accountability, cloud, capital allocation, and benchmarks must be adjusted.

Agile planning and budgeting. Belabored planning efforts, in-depth forecasts, buyer preferences, and detailed process lists with strict deadlines—along with necessities gathering, resolution growth, and testing—can stretch challenge deployment into months and even years. By the point IT delivers the challenge, the world has moved on; the enterprise could now face new headwinds, advanced buyer preferences, or shifts in demand. That is the place expertise vanguards play the sector in another way.

For a lot of expertise vanguards, fast prototyping, design and testing, and iterative growth is changing into the norm. Their supply groups—together with each enterprise and expertise stakeholders—purpose to attenuate the time between the thought and execution, ship the answer incrementally, and rapidly course-correct based mostly on buyer suggestions and the way the answer is getting used.

Savvy expertise leaders are shifting their funding practices to offer extra autonomy to cross-functional groups, enabling them to maximise the worth delivered from expertise investments and holding them accountable for delivering this worth. They’re additionally usually extra engaged in oversight, course corrections, and finances reallocation throughout a number of competing choices.

Joint possession and accountability. Traditionally, the success or failure of expertise implementations rested squarely on the shoulders of the CIO and IT staff. Nevertheless, as organizations transfer from siloed initiatives with purposeful possession to cross-functional enterprise options, challenge success and failure are additionally collectively owned.

For instance, the CIO of a big providers firm fostered joint accountability and possession by providing “limitless capability” to enterprise leaders. Each resolution in growth is staffed with a collaborative staff of enterprise and expertise people who find themselves accountable not just for growing the answer but additionally for delivering worth. Enterprise and expertise leaders are collectively accountable for overseeing the investments and the worth delivered. Incentives, bonuses, and rewards rely on outcomes, not on staying inside finances or assembly sure deadlines. Efficient implementation on this situation required that the group develop competencies, agility, and a community of ecosystem companions that may flex based mostly on demand. The CIO can be accountable for a finances class often known as “tech for tech,” that are investments in collaboration and productiveness instruments and different widespread enterprise infrastructure. On account of these insurance policies, enterprise leaders are far much less more likely to construct or purchase shadow IT options.

Deliberate cloud investments. The pandemic is accelerating cloud demand, with 59% of enterprises anticipating cloud use to exceed plans as a consequence of COVID-19. Deloitte predicts that cloud income development might be higher than 30% from 2021 by 2025. Cloud adoption will help corporations notice important value financial savings, however provided that CIOs have visibility into cloud utilization throughout the group and supply ongoing oversight and changes to handle prices, monitor workloads, and guarantee worth realization. Merely pushing a cloud-first strategy may considerably improve prices, diminish worth, and result in unchecked utilization, orphaned sources, outsized infrastructure design, redundant software program subscriptions, or advanced architectures. On-premise deployments could also be higher fitted to workloads which have excessive useful resource utilization and sophisticated integrations that may run up deployment and operational bills.

Balanced capital allocation. COVID-19 highlighted the necessity for organizations to be lean and resilient. Many expertise leaders have been requested to chop important parts of their budgets and reallocate present investments to construct resilient expertise environments and increase safety, infrastructure, and collaboration instruments. Such defensive investments—associated to the safety and preservation of the group’s enterprise and property—are essential, however for enterprise management, they’re a table-stakes expectation.

Savvy CIOs are additionally specializing in enterprise innovation and different offensive expertise investments—people who create and allow new alternatives, enterprise fashions, and income sources. Analysis means that high-performing corporations disproportionately spend discretionary finances {dollars} on rising the enterprise whereas others focus totally on defending the enterprise.

Utilizing benchmarks as guideposts. In calibrating expertise spending, some organizations solely depend on trade benchmarks to evaluate if they’re over-or under-spending and to allocate expertise budgets. As traces between industries blur, these benchmarks must be used as guideposts, not gospel.

Firms in the identical trade can have vastly various enterprise methods and fashions, resulting in very completely different funding profiles. Utilizing benchmarks with out context might be harmful. It is very important align spending with the group’s company technique, present and future aggressive panorama, and expertise ambition (determine 4). Above all, it’s crucial to make sure that finances {dollars} could be reallocated rapidly to maximise worth. Correct oversight can enable expertise leaders to repeatedly monitor expertise investments to make sure ongoing worth supply and allow them to ruthlessly reallocate funds if the funding is underperforming.

In 2020, the impression of the pandemic on expertise budgets was not as important as initially anticipated. The CFO surveys taken within the second and third quarters of 2020 revealed that whereas many monetary leaders are pessimistic about how rapidly financial exercise and firm income would return to pre-crisis ranges, they nonetheless anticipate considerably increased ranges of automation and cloud computing, and overwhelmingly anticipate extra distant work, which can sign a rise in expertise spending.

The overwhelming majority (85%) of CEOs who participated in a current Fortune/Deloitte survey agreed their organizations’ digital transformation had considerably accelerated through the disaster. CEOs are extra optimistic than their CFO counterparts—most CEOs don’t anticipate the financial downturn to be sustained, with greater than half (51%) saying that employment ranges by no means declined or have already returned to pre-pandemic ranges, and 40% saying that revenues by no means declined or have already returned to pre-pandemic ranges.

A current Forrester report initiatives that there might be an total lower in expertise budgets of two.5% in 2020; budgets will largely keep flat in 2021, with solely a 0.4% lower. However expertise spending within the subsequent couple of years will doubtless be a story of two cities. Some industries, equivalent to well being care, expertise, and shopper merchandise, are anticipated to have substantial will increase in spending, whereas different industries, equivalent to insurance coverage, banking, skilled providers, and utilities, may even see budgets keep flat or improve solely barely. Journey, hospitality, power, and sources may even see steep declines.

Finances will increase is probably not as substantial in 2021, particularly in industries that suffered heavy losses through the pandemic. Nevertheless, we anticipate that over the following two years many organizations will use the pandemic as a chance to rethink the digital expertise, revamp worker engagement, and reassess development methods—and leverage expertise to drive efficiencies in addition to development. General, we anticipate expertise funding to keep up or exceed pre-pandemic ranges in most industries in two years, and a challenge that by 2022, enterprises will spend a median of 5.11% of their revenues on expertise (determine 5).

Whereas the 2020 pandemic disrupted expertise funding development for a lot of industries, there’s an upside. Leaders now have the chance to have an effect on lasting change in how they strategy expertise investments to extend enterprise agility, making operations nimbler, extra environment friendly, and higher ready to successfully reply to no matter comes subsequent.